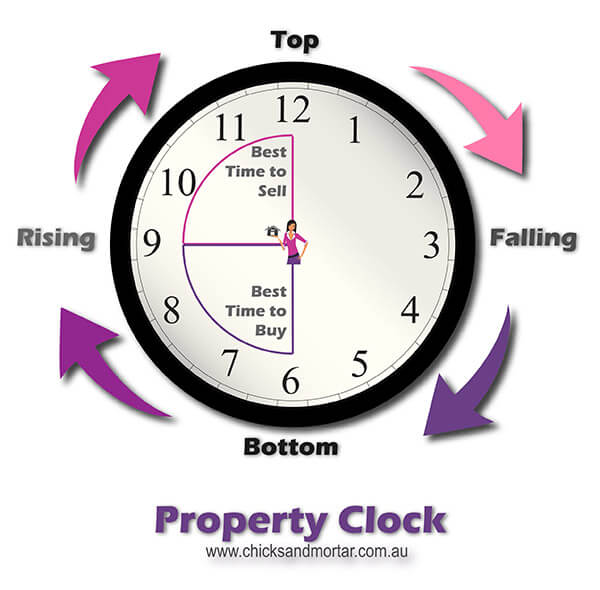

The key to buying at the right time is to get to know and understand the property clock (or cycle as it’s also referred to).

While some areas may be booming others will be in a slump. Knowing which areas are where in the cycle puts you well ahead when it comes to buying and selling. You sell when the market is hot and you buy when the market is flat. But this in itself can be tricky, you don’t want to sell just as the market is heating up, nor do you want to leave it to the last minute and find you have missed the rush.

The same applies to the other end, if you buy when the market is still on the downward slide, you are not getting the best discount that you may have gotten if you had waited and you also have to wait longer for the market to turn and the growth to begin.

.

There are, however, signs to watch out for to tell where a suburb is currently sitting on the property clock.

Signs that the market is moving up or near the top of the cycle:

- Days on the market are short – Properties are being sold as soon as they are listed or not long after.

- Little or no stock available – there are very little properties on the market.

- Prices are at a premium for the area and sellers are struggling to secure the property at the market price without being able to secure a discount.

- The general population is now looking at buying in the area. If you’ve just seen on the local news a story on prices rising in the area you’re looking, then you are no longer the early bird.

- Rental yields are increasing (this is generally the first sign of the market moving upwards). When yields go up generally capital growth will follow.

Signs that the market is on the downward slide or at the bottom of the cycle:

- Properties are sitting on the market for longer – Properties are no longer being snapped up as soon as they are listed.

- Buyers are able to secure higher discounts on the property – More houses for sale and less buyers means the buyer can nab a greater bargain.

- There are more properties available, and buyers are able to secure more value for money – More room, better block size, another bathroom. In a slow market you are able to pick up more bang for your buck.

- Prices begin to lower as distressed buyers take what they can get.

- Rents remain steady or even decrease – Not always the case but stagnating rents can mean a slowing market.

Buying property at the right time is the key to getting the most out of your investment.

Until next time…